#HOW TO FIND A INVOICE TEMPLATE IN WORD PROFESSIONAL#

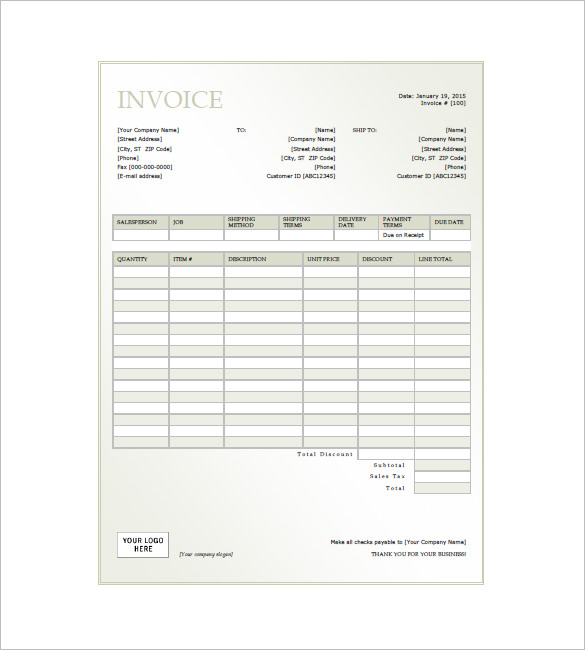

You should use professional fonts and styling that match your brand, then add your logo and colours if possible. There may even be sample templates on your word processor, depending on the program you’re using.

#HOW TO FIND A INVOICE TEMPLATE IN WORD FREE#

You can do this yourself using a word processor or Excel, but you could also use one of our free invoice templates above. That’s why I’ve designed efficient and attractive invoice templates, covering both options.The first step is to put your invoice together. Business Invoicing Made SimpleĪs an entrepreneur, I’ve learned first-hand how daunting invoicing can be, especially when you are offering services and selling some digital products at the same time. You can go even an extra mile and automatically pre-schedule email dispatches for this date. Then schedule yourself a reminder to invoice all outstanding accounts on the last workday of the month. Then scale this rule across all your clients. To stay productive at your end, establish a “rulebook” for invoicing: Standardize when and how you invoice clients.Īt a minimum, decide on the standard payment terms for different types of projects you do. VAT tax is due for most products and services. Both service providers and merchants will need to apply for a VAT (valued added tax) number when reaching a country-specific annual turnover threshold. Though many sales taxes are also unified across the EU member states. In Europe, specific tax rates apply to different categories of products at the country level. Then add a respective tax percentage for each type of taxable goods/services delivered. As a rule of thumb, you’ll need to obtain a state tax ID (different from your federal tax ID). So it’s best to go straight to a local authority to clarify your obligations. In the US, sales and use tax rates vary at the city-, country-, and state levels. Ensure Tax Complianceĭepending on the nature of your business, you may be subject to collecting local sales taxes. Then follow your local legal guidelines for setting this process such as SEPA Direct Debit Mandate (EU) or Nacha Operating Rules for ACH debits in the US. On the other side, if you plan to use direct debit, be sure to collect the following information from your customer.

If you aren’t invoicing your clients via an online payment app like Stripe or PayPal automatically, communicate how they must foot your bill.įor bank transfers, make sure to provide all the required details such as: Specify Accepted Payment MethodsĪnother common reason for invoice payment delays is a misunderstanding around payment methods. Law Insider has many examples of late payment clauses for invoices. To discourage late payments, you can also include a quick clause on penalties for breaching the payment terms.

The issues arise because payment terms are often assumed, rather than explicitly communicated. Typically, it indicates when you expect your invoice to get paid. This guide provides several must-know pointers for invoicing like a champ! Always Spell Out Your Payment TermsĪ payment term is an indicator suggesting the conditions for making a payment. Likewise, not including customer invoices in the proper format can give you trouble with the taxman. If you submit your invoice in the wrong format, a payment from your client can get delayed. But invoicing can also be a major source of frustration.

Getting paid is the most exciting part of running a business. A Quick Guide to Invoices for Small Business Owners

0 kommentar(er)

0 kommentar(er)